Investment Portfolio Diversification: Why You Need it and How to Achieve it?

“A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts,” Princeton economist Burton Malkiel famously wrote in his book A Random Walk Down Wall Street.

Rather than an insult toward experts, Malkiel demonstrates how futile picking individual investments can be, even when they’re believed to be “winners”. And it shows how much stronger an investment portfolio can be when invested across many assets rather than a few, in line with the principles of diversification.

Why?

By diversifying a portfolio among and across asset classes in effective ways, you can limit exposure to unsystematic risk (avoidable risk), manage systematic risk (unavoidable risk), and ultimately build an investment portfolio that’s potentially more stable and profitable.

Despite the benefits of diversification, the portfolios of many individual investors are missing vital components of this fundamental investment strategy. This inconspicuous misstep can leave their holdings more concentrated, and therefore more prone to higher levels of volatility, unstable returns, and possibly lower earnings overall.

In this article, we discuss the fundamentals of investment diversification and actionable ways to add meaningful diversification on the individual level. First, let’s examine the principles of diversification and why it exists.

What is Diversification?

Diversification is a risk management strategy that uses varied asset allocation to reduce the risk and improve the performance of an investment portfolio. By holding a range of investments in securities within and across different asset classes with little or no correlation, you can reduce exposure to risks that investments share, thereby improving overall portfolio stability and earning potential.

To understand that fully, let’s break down a few key concepts a bit further.

- Securities: A security is a passive investment of money in a common enterprise with the expectation of profits (debt, equity, or otherwise). Generally, stocks, bonds, commodities, and other financial instruments that are bought and sold are considered to be securities.

- Individual stocks: These are securities that represent partial equity ownership in a public entity, like a corporation. Most investors are familiar with public stocks and the many kinds of stocks available today. Even within the stock market there is potential diversification, between different market capitalization (large cap and small cap stocks, or emerging markets), and domestic stocks and foreign stocks/international stocks sold through foreign markets.

- Fixed income investments: These kinds of securities are debt or debt-like investments that have pre-determined returns for the buyer along a certain timeline. These include securities like bonds sold on a bond market, and can take different forms, depending on the entity of the issuer: treasury bills or government bonds, municipal bonds, corporate bonds, etc.

- Market funds: These are vehicles that allow you to buy a broad range of securities contained in a market through the purchase of a single investment vehicle. These can include options like mutual funds, bond indexes, and exchange-traded funds (ETFs).

- Asset classes: An asset class is a group of securities that share similar characteristics and behavior. Investments within the same asset class can be prone to the same risks. However, there is a lot of range within an asset class. Asset classes can be broken down further into subclasses, and as classification becomes more specific, levels of similar characteristics and behaviors become more concentrated. Generally, a portfolio with a broader mix of asset classes will have stronger diversification. Taking into account the securities discussed above, major asset classes include:

- Equities

- Fixed income

- Cash and cash equivalents

- Commodities and real estate

Each of these asset classes can cover many different types of investment sectors, or return profiles, such as capital gains or income.

For example, a real estate investment can earn returns through either a debt investment, such as a loan, or an equity investment, such as a property purchase. Generally speaking, a debt investment can earn yield interest, and equity investments can earn appreciation. However, the returns that investors receive – and the risks they experience – can vary based on the structure of their investment. You could buy a home directly with a large sum of money or you could invest through a real estate investment trust (REIT) with a smaller sum of money. Each could earn income, but investors would receive returns in different ways with each. And each one has its own distinct set of risks.

Correlation

Correlation measures the degree to which the performance of investments are related to one another. If investments move in the same direction to the same degree at the same time, they’re considered to have a perfect positive correlation. If they move in opposite directions to the same extent at the same time, they’re considered to have a perfect negative correlation. Not many investments have a perfect correlation, but it’s common for investments to have high, low, or no correlation. In general, the more investments with low or no correlation held in a portfolio, the more diversified the portfolio construction is.

The correlation of investments can fluctuate along short-term or long-term timelines. It’s important to understand the correlation of a portfolio’s investments especially in the context of volatility. A period of high market volatility, such as an economic downturn, is precisely when you might not want your investments to follow the market trend.

Why is Diversification Important?

Diversification can help lower exposure to the risk of loss, which ultimately can improve the stability and earning potential of an investment portfolio. For most investors, diversification helps them build a strong portfolio for retirement savings or a nest egg. While some may want risky investments for growth potential, most are seeking the most stable, and reliable way to plan for their future.

It’s important to have a clear grasp of your own investment goals. A person who is saving for retirement may have an entirely different risk tolerance and time horizon impacting their portfolio construction — than someone investing for short-term goals.

Investment Risk Management

Because risk reduction is at the heart of the principle of portfolio diversification, it’s important to understand which types of risk diversification can reduce, and how a reduction in those risks can impact a portfolio’s wealth-building capacity.

Unsystematic Risk

Also known as specific risk or diversifiable risk, unsystematic risk is portfolio risk specific to an asset class or subset. This could include risk that’s specific to a company, sector, industry, market, or another division within the financial system. The risk of loss stemming from unsystematic risk can be mitigated through a portfolio management strategy that diversifies across investments that don’t share the same unsystematic risks.

You can reduce or increase exposure to unsystematic risk through your investment choices. By building a diversified portfolio of investments with little or no correlation to one another, you can limit the impact of any losses from a particular company, asset class, industry, region, or another subset of the financial system – while maximizing earning potential as discussed in the following section.

Systematic Risk

Unlike unsystematic risk, systematic risk is the risk inherent to the financial system as a whole. Trends that impact the entire financial system worldwide, such as rising interest rates and inflation, are a few examples of systematic risks.

While it is not possible to eliminate exposure to the risk of an economic recession or inflation, it is possible to diversify into investments that can reduce losses in those events, especially over a long-term time horizon. If interest rates were to rise, buying fixed-income assets with the capability of earning higher yields, such as bonds, could help counterbalance losses. Additionally, an investment in hard assets, such as commercial real estate, can hedge against inflation increases and produce better long-term returns.

Beta can help you measure the amount of systematic risk of an investment. Beta is the measurement of the systematic risk of an investment or investment portfolio in comparison to the market at large. Diversifying across asset classes with low beta may help lower exposure to some types of systematic risk.

Lower Risk, Higher Portfolio Return Potential

When risk is properly mitigated through portfolio diversification, it’s less prone to volatility. It’s more stable, and its earning potential more predictable. Diversification can’t eliminate risk, but when structured well, a diversified portfolio can earn better risk-adjusted returns. Calculating a portfolio’s risk is often done through a mean-variance analysis, which projects the probability of achieving a certain return under a certain risk, within the bounds of a standard deviation.

Again, the full impact of diversification can often be seen in the lens of a long-term time horizon and financial goals. For example, if you’re saving for retirement with an IRA or another retirement account, you’ll find that a strong diversification strategy shows its value over the course of many years.

How to Diversify Your Portfolio

Portfolio risk can be mitigated in many ways, but not all portfolio allocations are equally effective. Many investors have some form of a portfolio diversification strategy, from basic asset allocation to cash management, but it’s often not as sophisticated as they may believe, which can leave them needlessly overexposed to diversifiable risk.

To demonstrate this in practical terms, let’s look at two major diversification investment strategies and the levels of diversification that they can offer.

Standard Diversification: Modern Portfolio Theory

Modern Portfolio Theory is likely the most famous modern-day portfolio diversification strategy for individual investors. It was introduced by Harry Markowitz in 1952 using a formula that the economist developed offering investors a way to structure an investment portfolio to maximize returns at a given level of risk.

In essence, Modern Portfolio Theory tries to offer a diversification strategy that ensures you are compensated for the risk that you take on for any investment. Some investors have greater risk tolerances than others, so Modern Portfolio Theory was created to help guide investors to maximize return potential according to the amount of risk that they’re willing to accept.

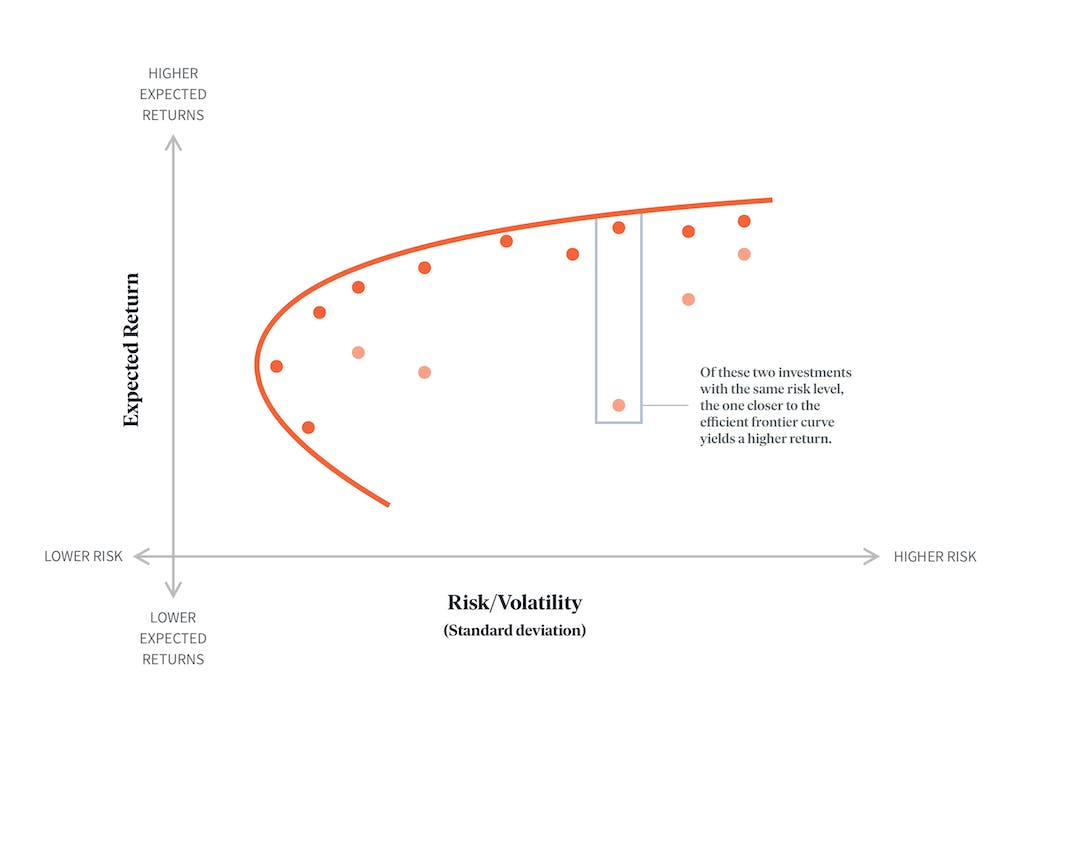

With greater risk, there’s usually greater reward potential. Investment portfolios structured according to Modern Portfolio Theory are measured against the risk curve of the efficient frontier, which gauges maximized return potential at a given risk level of portfolio holdings.

The above graphic is adapted from Investopedia’s own version, here.

If the investment portfolio allocation falls below the efficient frontier risk curve then, according to Modern Portfolio Theory, you are likely taking on more risk than needed to earn your expected return. There’s likely a higher return potential available at the same risk level, which can be found through a change in investment allocation. Vice versa, you can likely earn the same return potential available at a lower risk profile.

In general, this assessment is meant to help you find the best risk-adjusted returns available at your risk level.

How are Investment Portfolios Allocated According to Modern Portfolio Theory?

Investment portfolios can be diversified based on your specific risk tolerance, and financial goals. A mean-variance analysis of an investment portfolio and its plot point along the efficient frontier risk curve helps you determine the strength of your asset allocation given its target risk level. Because this formula takes weighted risk and correlation into account, it can help you choose which asset classes to invest in and how to rebalance your portfolio. It can also help you choose long-term and short-term investments, as well as investments with different liquidity levels.

To simplify this calculation, a reduced rule of “100 Minus Your Age” was developed. This rule only takes age into account, and not important factors such as financial goals or existing assets. It says that you subtract your age from 100, and the resulting number is the percentage of your investment portfolio that you should allocate toward stocks. The remaining percentage should be allocated toward fixed-income assets, such as bonds.

For example, if you are 30 years, old, your equation would be 100-30=70. According to this rule, you should invest 70% of your portfolio in stocks and the remaining 30% in bonds. Using this scale, younger investors allocate more heavily toward riskier equity investments, such as higher-risk stocks (which range both foreign and domestic stocks in the stock market), and older investors allocate to relatively safer fixed-income investments, such as bonds (such as federal government bonds, corporate bonds, or municipal government bonds) or annuities.

Where Modern Portfolio Theory Falls Short

Following this rule – whether closely or loosely – many investors have started index investing (“indexing”), or investing in one or a few mutual funds, index funds, or exchange-traded funds (ETFs) containing domestic or international stocks or bonds, which track a particular index. Index investing can provide broad exposure to a market index or a smaller subsection of one. For example, an index fund could track the S&P 500 on the whole or track bonds from a specific industry.

Between 2010 to 2019, the share of the US stock market made owned by index funds rose from 7% to almost 14%. With the rise of indexing, asset management has become more concentrated among a handful of leading investment firms. This enables movement of publicly traded investments to become more correlated, which reduces investment portfolio diversification potential among individual publicly traded assets and asset classes.

When Modern Portfolio Theory was introduced in 1952, investors faced a very different landscape across the financial markets. There were more non-correlated or lowly correlated investment options in the public market. Since then, a number of investment vehicles, such as index funds and ETFs, have been introduced. Meanwhile, the number of stocks traded publicly has been dropping rather than growing. The number of publicly traded companies in the US peaked in 1996 at 8,090, and since then has declined nearly 50% to 4,397 in 2018. Other developed countries such as the United Kingdom, Germany, and France have experienced similar declines since at least 2006.

So, while the number of investors has grown, the number of available investments has shrunk.

The combination of more investors, fewer public investment options, and the ubiquity of index investments has made the diversification strategy behind Modern Portfolio Theory dated, and no longer capable of providing meaningful diversification using assets and asset classes in modern public markets alone.

Nonetheless, many investors use the Modern Portfolio Theory investment model as a stepping stone into diversification strategies. Several major robo-advisors who focus on public market investments, such as Betterment, Wealthfront, and Wealthsimple use Modern Portfolio as an investment strategy for developing the composition of their investors’ portfolios. Without going beyond these public market securities, you risk following an outdated model that ignores a rise in correlation that’s developed since the theory’s introduction.

Advanced Diversification: The 20% Rule

The concept of diversification across uncorrelated assets behind Modern Portfolio Theory is still sound. However, the suggested allocation that has accompanied this theory is no longer as compatible with markets as it once was. You can no longer adequately diversify unsystematic risk using Modern Portfolio Theory as they could decades before using just public stocks and bonds.

Fortunately, there have been advancements made to diversification strategies for investors at the individual level within the past two decades, which take into account new market dynamics and investment options – and introduce new models for portfolio construction and asset mix.

Lessons from the Yale Endowment

For the 30-year period ending in 2015, the average equity mutual fund investor earned a return of 3.66%. On the other hand, for the 30-year period ending in 2015, the Yale endowment earned a 13.2% annual return. And, during periods of economic downturn, the Yale Endowment has remained relatively insulated. When the S&P fell 33% between 2000 and 2003, the Yale Endowment actually grew by 20%. During the 2008 financial crisis and its aftermath, the Endowment experienced a dip, but recovered: it experienced a large loss in 2009, but posted positive returns annually since 2010.

How was the Yale Endowment able to both boost earnings and mitigate losses?

Simply put, over the past 30 years, it has continued to branch out beyond traditional assets into alternative investments.

Why?

Alternative investments offered the endowment greater diversification power thanks to their lower correlation levels with increasingly correlated traditional assets – on top of higher earning potential. In 1985, more than 80% of the endowment was invested in public market asset classes. By 2016, less than half of the endowment was invested in the public market. Due to changing the composition of its holdings, the endowment’s portfolio has experienced higher than expected returns and lower volatility than experienced by previous portfolio structures.

The allocation of the Yale Endowment is rebalanced often, but its focus on alternative investments remains consistent. The Endowment’s investment allocation relies on the mean-variance analysis of Modern Portfolio Theory, but adjusts its allocation based on its goals, existing assets, investment options, and the shifting landscape of the investment industry, which has altered the portfolio composition needed to achieve true diversification.

Chief Endowment Officer, David Swensen, pioneered this investment model for endowment funds beginning in 1985, showcasing sophisticated strategies for wealth management. While this approach to advanced diversification has proven to be largely successful for Yale and other endowments, allocations may look differently for individual investors, because their wealth management needs and personal financial goals are most likely very different. However, the principles of diversification of unsystematic risk using uncorrelated assets and asset classes used by the endowment can be applied to investment portfolios of all sizes.

The 20% Rule for Individual Investors

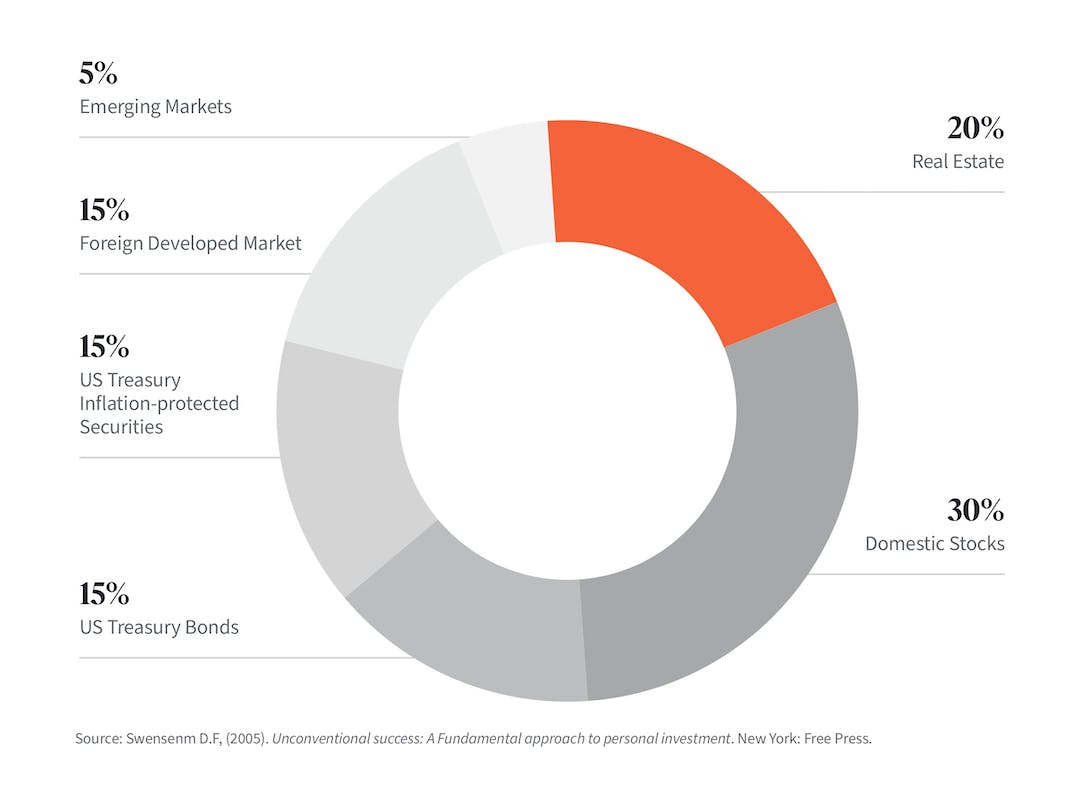

Swensen created a portfolio allocation model for individual investors, which established the “20% rule” more than a decade ago. The 20% rule says that you should diversify at least 20% of their investment portfolio into alternatives, such as real estate. As a way to balance portfolio risk and individual risk tolerance with optimal potential returns, Swensen recommended a portfolio composition that included a 20% allocation to alternative assets and an 80% allocation to a variety of traditional assets.

In this model, 20% of a portfolio is invested in the alternative asset class of real estate. Allocating a large chunk of a portfolio to an alternative asset class helps provide useful diversification. As we’ve discussed, this lowers the risk of volatility, and ultimately loss, of an investment portfolio otherwise invested mainly in stocks and bonds.

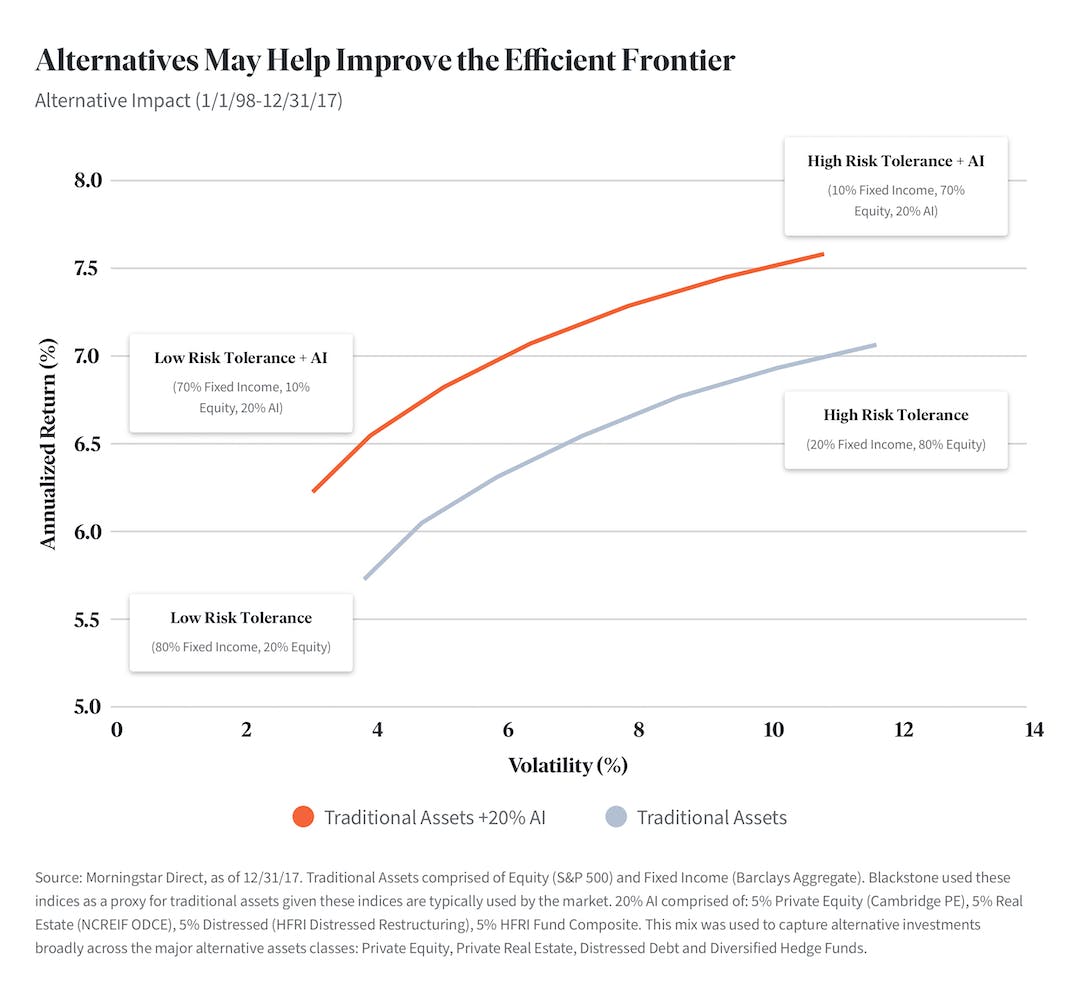

Swensen is not alone in his support of the 20% rule. Blackstone and Baird have also found that an investment portfolio with a 20% allocation to alternative investments has historically performed better than one invested only in traditional investments.

The above graphic is adapted from Blackstone’s own version, here, p 15.

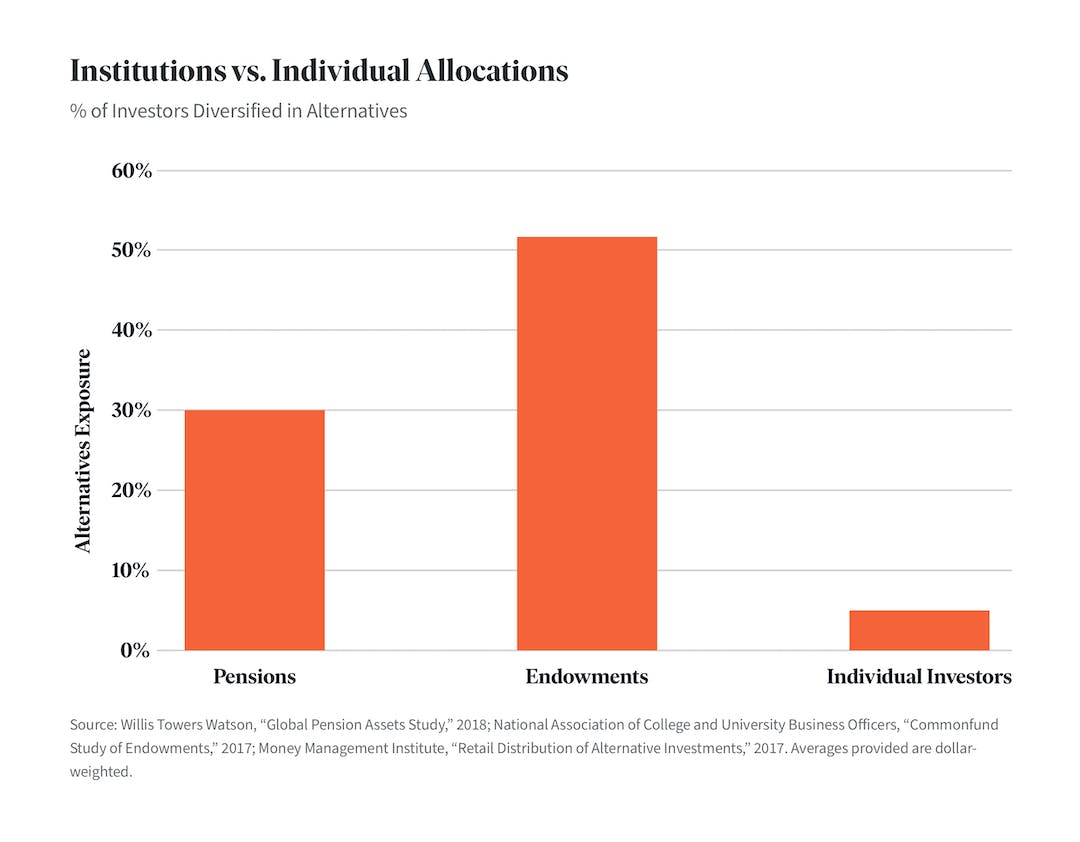

While many institutional investors, including both endowments and pensions, invest 20% or more toward alternatives, individual investors are not as diversified. While goals, time horizons, and other factors vary by investor, long-term investors only benefit from investments that reduce diversifiable risk, since these benefits are mostly reaped over the long term.

The above graphic is adapted from Blackstone’s own version, here, p 10.

Alternative Investments in the Private Market

A key feature of the 20% rule is the fact that it advocates investing in alternative asset classes, which are traded in the private market, as opposed to stocks and bonds in the public market. The difference in markets is a major reason why alternative assets share little or no correlation with traditional assets.

For example, when investing in real estate, a publicly traded real estate investment trust (REIT) wouldn’t provide meaningful portfolio diversification, because as a publicly traded investment, it shares many of the same characteristics – including risks – as other publicly traded investments. Due to this, the class of alternative investments generally refers to investments held in the private market.

The private market operates under very different dynamics than the public market. Where the public market is very efficient, the private market is inefficient due to many reasons, including information asymmetry, fragmentation, and friction – all of which can actually benefit you.

Taken together, these factors can often produce the opportunity for earning potential for knowledgable and savvy investors, beyond what you might expect to find in the public market. In the public market, transactions occur frequently enough that securities are considered to be “perfectly priced,” which means that the price at which a security trades is exactly equal to its value. In the private market, however, trades occur far less frequently, and knowledge of certain factors impacting value may not be shared across parties. Here is where the knowledgeable investor might realize outsized earning potential.

Due to these different buying and selling dynamics, private market investments generally have little to no correlation with the performance of or public investment vehicles. This is why they can offer powerful diversification against unsystematic risk and, in some cases, even systematic risk – and it’s why they’re considered a crucial component of an advanced diversification strategy.

Historically, individual investors haven’t invested in the private markets in high volumes, because these markets were generally limited to accredited investors. This high barrier has inherently limited access to advanced investment strategies to all but wealthy or accredited investors.

However, the introduction of new investment options, thanks to advances in federal legislation and technology, has helped to open up private market investments to individual investors, making advanced diversification more attainable.

Next Steps

Individual investors stand to gain substantial benefits, including an increase in return potential and a reduction in portfolio volatility through advanced diversification. Those heavily invested in the public market are likely missing out on useful investment diversifiers in the private markets. This is especially true for investors with long-term horizons and financial goals, such as investors who want to maximize returns.

While alternative investments that fall under the 20% rule have historically been out of reach of most individual investors, some are now widely available offering a way to strengthen portfolios in a way that wasn’t previously possible.

Fundrise is the first investment platform to create a simple way for anyone to access institutional-quality private real estate investments, and its historically consistent earning potential and diversification power. Fundrise not only offers access to the asset class of private market real estate, but also diversification within the asset class. Fundrise Investment Plans offer investors of all sizes a way to gain instant exposure to a diversified portfolio of dozens of both debt and equity real estate investments throughout different markets in the US. Each portfolio offers different levels of earning potential of income and long-term appreciation based on the goal it’s designed to achieve.

When researching investments, it’s up to you and your financial advisor to determine your optimal investment strategy, but the more advanced your diversification strategy, the stronger your investment portfolio will likely be in any market.